Villa for 8,500,000 baht on Koh Samui Thailand

A unique offer – a gated complex with one, two and three bedroom villas, each with its own private pool. The villa complex is located in the tourist center of the island, in the Boput area.

- Investment attractiveness ROI

- Location

- Gated complex

- Villa design

- Layouts and construction time

1. Investment attractiveness

ROI – 10%

Let’s list the factors that allow you to get such attractive interest:

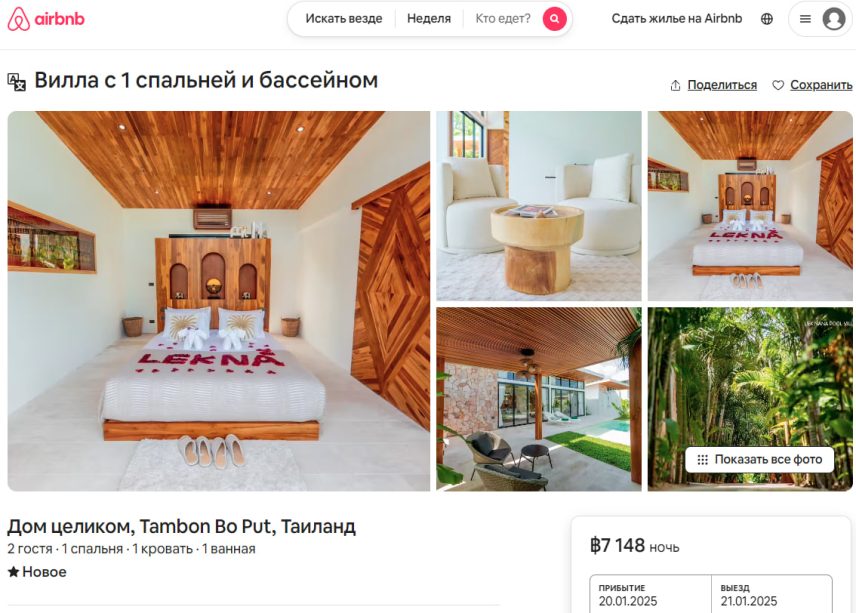

- The types of these villas will be in high demand among tourists who want to rent a private property with a private pool for an optimal budget. Renting such villas in January-February on Booking.com and Airbnb for a night costs from 6,800 to 7,500 baht, which is much cheaper than similar offers from hotels or other resorts.

- The management company from the developer, guarantees hotel service for clients, which will ensure high quality service and utilization throughout the year.

- The location of the complex in the tourist center of the island, also affects the attractiveness for rent among tourists.

- The eco-style design of the villas helps them stand out in the Samui rental market.

2. Location

- Close to the beach – picturesque Boput Beach with clean sand and calm sea is ideal for couples’ vacations.

- Nearby Fisherman’s Village – the famous neighborhood with restaurants, bars, boutiques and night market attracts tourists and renters.

- Developed infrastructure – Boputa has stores, supermarkets, fitness centers and international schools, making it convenient for long term living.

- Proximity to the airport – only 10 minutes by car, which is convenient for tourists arriving for short stays.

- Quiet and safe – the neighborhood is considered quiet and comfortable, with no noisy parties but with easy access to Chaweng’s entertainment.

The area is great for villa rentals, both short and long term, attracting both tourists and expats.

3. Gated complex

- Security and privacy – secured area with video surveillance provides comfort and peace of mind for guests.

- Uniform style and high standards – all villas are built in the same eco-style, fully furnished and ready to rent.

- Well-maintained territory – landscaping, clean roads, lighting and services create a cozy atmosphere.

- Additional amenities – on-site restaurant will make your stay even more comfortable.

- Ready management company – villa maintenance, technical support and renting without unnecessary worries.

This format is especially appreciated by families, businessmen and long-term tenants who value comfort and security.

4. Design of villas

- Natural materials – finishes of wood, stone and other natural components create a cozy and healthy atmosphere.

- Maximum natural light – panoramic windows and thoughtful architecture minimize the need for artificial light.

- Open spaces – the seamless transition between interior and exterior allows you to enjoy nature right from your home.

- Compliance with eco-standards – modern construction techniques and recycled materials reduce environmental impact.

- Landscaping with local flora – manicured gardens with native plants require minimal maintenance and preserve the natural ecosystem.

Eco-design of a villa is not just a trend, but a lifestyle that combines comfort with respect for nature.

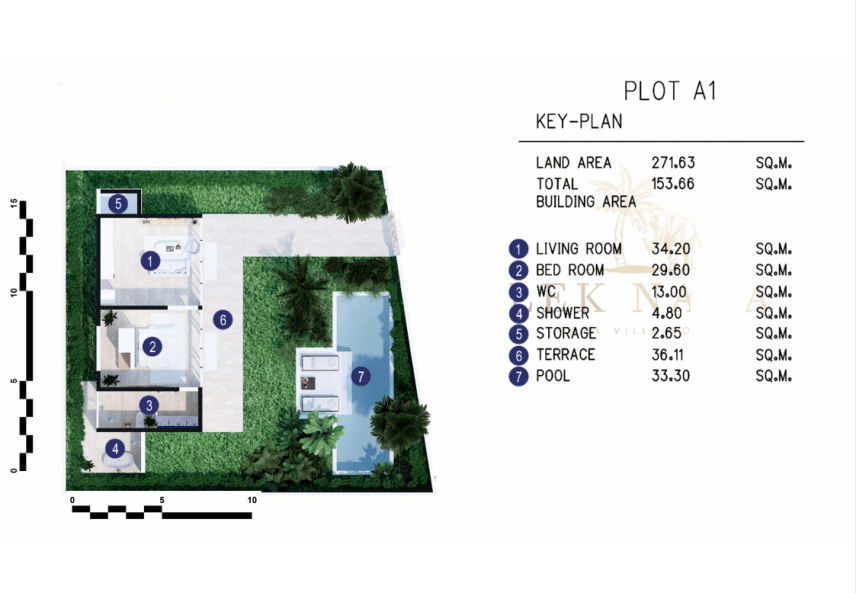

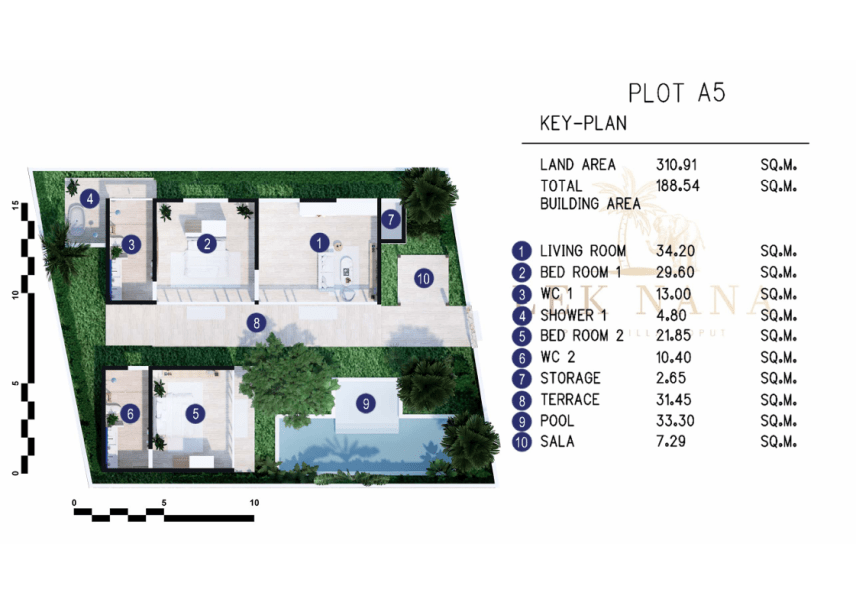

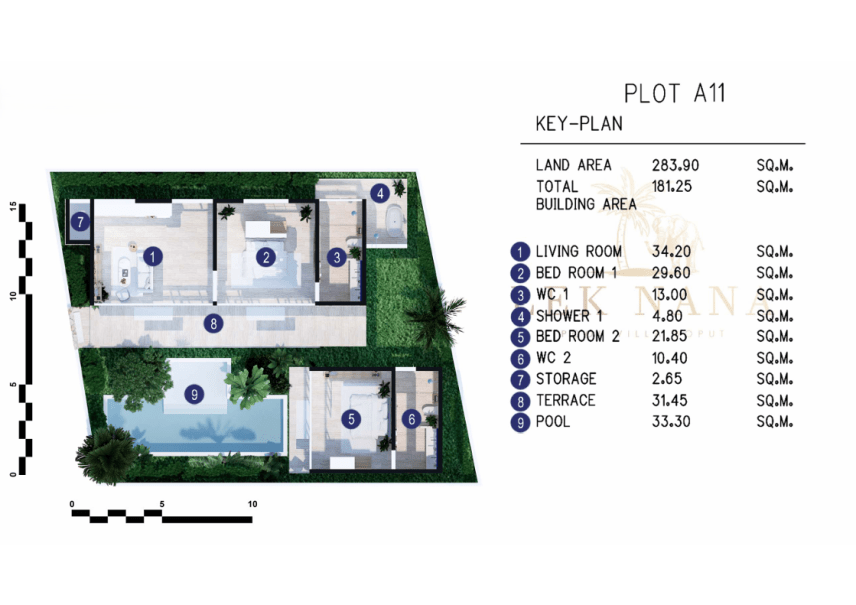

5. Layouts and construction timeframe

The villas are scheduled for completion by December 2025.

The layouts are designed for the comfort of guests.

- The bedroom is connected to the living room, which allows you to move inside the villa without going outside.

- The second bedroom is located in a separate building, providing additional comfort.

- Each bedroom has its own bathroom.

- High panoramic windows fill the room with natural light.

- The territory has green areas.

- The villas are built in such a way that the sun heats the pool and the surrounding area, but does not reach the living areas.