The real estate market of a country is always, closely related to domestic and foreign policy.

By analyzing the history of interactions between countries and gathering information from analytical agencies, we can draw the right conclusions about the prospects for real estate investment in Thailand by investors from other countries.

Political decisions can either stimulate market growth or slow down its development, making the close link between politics and real estate obvious.

Effects of Foreign Trump Policy on Real Estate Markets

- Encouraging Foreign Investment. Simplified regulations for international buyers and the establishment of free economic zones can boost the demand for real estate by making it more accessible and appealing to overseas investors.

- Geopolitical Influence. Market conditions can shift due to factors like sanctions, trade agreements, and migration trends. These can either spark an influx of foreign interest in real estate or cause a retreat of capital investment.

- Tourism and Global Relations. In nations with strong tourism sectors, such as Thailand, the real estate market for resorts is heavily influenced by visa rules and the country’s overall appeal to international visitors.

Example Scenario:

Governments actively promoting foreign investment, as Thailand did pre-pandemic, typically see heightened real estate activity from international buyers. Conversely, strained global relations – through sanctions or restrictive visa policies – often diminish buyer confidence and activity.

Trade Turnover Between Thailand and the United States (Donald Trump vs Joe Biden)

Trade under Donald Trump (2017–2021):

During Donald Trump’s presidency, the U.S. pursued policies focused on reducing trade deficits. His administration emphasized the “America First” strategy, which involved renegotiating trade agreements and imposing tariffs on various goods.

- Bilateral Trade Volume. The trade volume between Thailand and the United States stood at approximately $60 billion in 2020, despite global trade disruptions due to the COVID-19 pandemic.

- Key Thai Exports to the U.S. Thailand exported significant amounts of auto parts, electronics, and agricultural products like seafood and rubber to the U.S.

- Impact of Policies. While Trump’s policies were restrictive in some sectors, such as tariffs on steel and aluminum, Thailand maintained a strong trade surplus with the U.S. due to its diversified export portfolio.

Trade under Joe Biden (2021–2024):

Joe Biden’s administration adopted a more multilateral approach, focusing on rebuilding alliances and strengthening trade ties.

- Bilateral Trade Volume. The trade volume experienced recovery and growth, with exports and imports showing resilience post-pandemic. For example, trade in goods and services between Thailand and the U.S. surpassed $65 billion in 2022.

- Key Focus Areas. Biden emphasized clean energy and technological innovation, which opened doors for collaboration in renewable energy projects and advanced manufacturing.

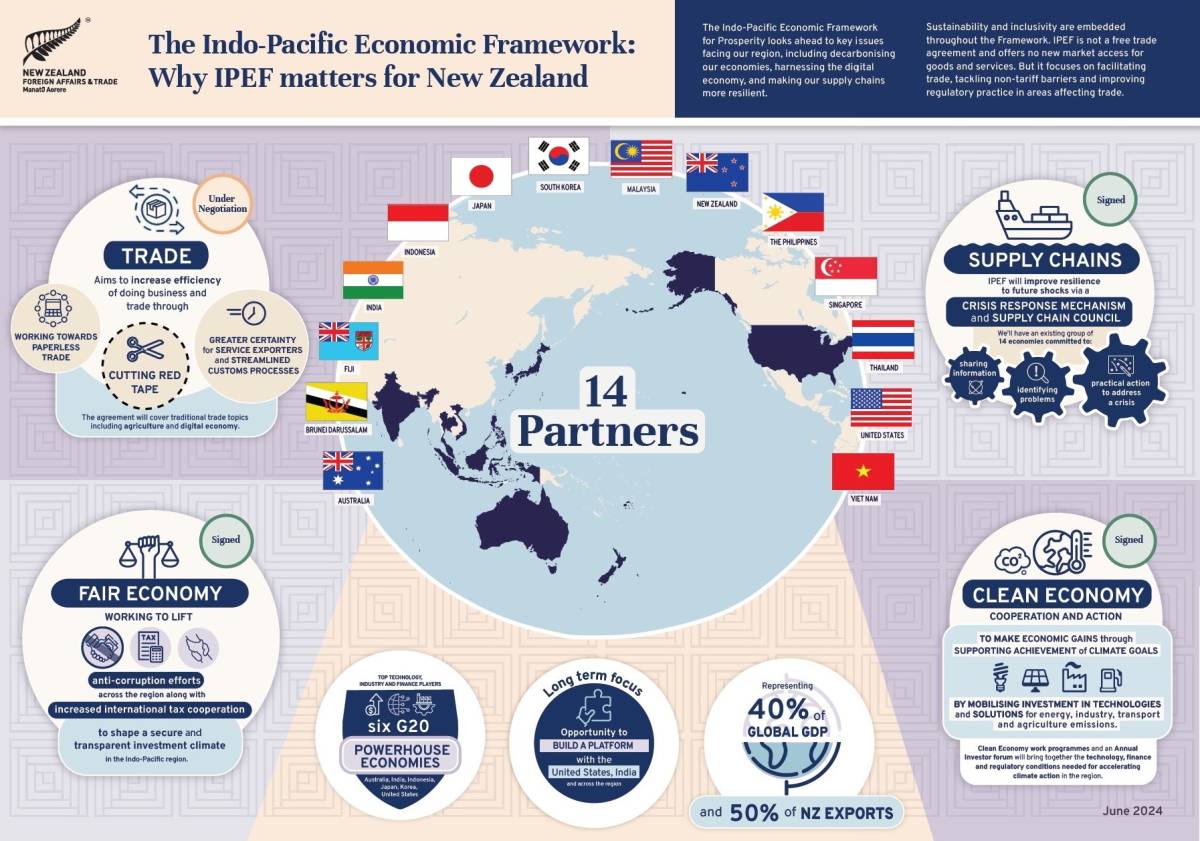

- Trade Agreements. The Biden administration engaged with Southeast Asian nations, including Thailand, through frameworks like the Indo-Pacific Economic Framework (IPEF), which aimed to promote sustainable and inclusive trade practices.

Comparison of Policies and Their Impact:

- Trump Era: Focused on reducing trade deficits through tariffs, which created challenges but did not significantly impact Thailand’s export surplus.

- Biden Era: Aimed for more cooperation and sustainable trade practices, fostering a better environment for long-term trade growth.

Thailand’s consistent trade surplus with the U.S. highlights the resilience of its export-driven economy, regardless of U.S. political dynamics.

Possible Changes in U.S. – Thailand Trade Relations in 2025

Tightening of Tariff Policies

The U.S. could adopt stricter tariff policies, potentially impacting Thailand’s export-heavy economy. However, Thailand’s strategic role as a manufacturing hub in Southeast Asia might cushion these effects. Industries such as automotive parts, electronics, and agricultural goods may see challenges but are likely to remain resilient due to global demand and diversified supply chains.

- Shift to Bilateral Agreements:The U.S. might prioritize direct agreements with individual countries over broader multilateral frameworks. Such a shift could create opportunities for Thailand to negotiate favorable terms but may also limit regional cooperation initiatives like ASEAN-wide agreements.

- Impact of U.S.-China Trade Tensions:As the U.S. continues to reduce trade dependency on China by increasing tariffs, the ripple effects will likely shape regional trade dynamics:

- Rising Exports from Southeast Asia to the U.S.: Countries like Thailand, Vietnam, and Indonesia could experience growth in exports as U.S. companies seek alternative suppliers.

- Dependence on Chinese Imports: Since many Southeast Asian countries, including Thailand, rely on Chinese intermediate goods for manufacturing, any disruptions in China’s trade could indirectly affect Thailand’s exports to the U.S.

- Trade Imbalances: Similar to the “trade war” during Trump’s presidency, countries in Southeast Asia could see a growing trade imbalance with the U.S. due to increased export volumes.

- Opportunities in Diversified Sectors: Focus on technology, renewable energy, and supply chain diversification could open new avenues for Thailand, particularly in electronics and green energy exports.

Broader Implications:

- The U.S. may look to strengthen ties with Southeast Asian nations as part of its Indo-Pacific strategy, balancing against China’s influence.

- The outcome will depend on Thailand’s ability to adapt to shifting trade policies and leverage its strategic position in global supply chains.

Thailand’s manufacturing and export strengths, coupled with proactive engagement in bilateral discussions, will likely determine the degree to which these changes impact its economy.

Potential Impacts on Thailand’s Trade in the Indo-Pacific

- Mixed Outcomes for Thailand: Donald Trump’s anticipated focus on enhancing U.S. economic independence and potentially pulling back from international frameworks like the Indo-Pacific Economic Framework (IPEF) could diminish American engagement in Southeast Asia. This might weaken Thailand’s economic ties with the U.S., reducing its role in regional collaborations.

- Targeting Trade Surpluses: The Trump administration is expected to prioritize reducing trade deficits, especially with nations holding significant trade surpluses like China, Japan, South Korea, Vietnam, and Indonesia. Thailand, despite its smaller surplus with the U.S., could still face increased scrutiny. Adjustments to tariffs or trade policies might impact exports, particularly in industries like electronics, agriculture, and textiles.

- Opportunities in Neutrality: Thailand’s historically neutral stance in geopolitics could work to its advantage. By maintaining strong relations with both the U.S. and China, Thailand can navigate shifting dynamics.

- Strengthening Ties with China: The country is likely to benefit from Chinese investments, particularly in major infrastructure projects like the high-speed rail corridor linking China and Singapore via Thailand.

- Balancing Act: While deepening economic ties with China, Thailand must also safeguard its trade relationship with the U.S. to retain market access and avoid potential sanctions or reduced trade preferences.

- Navigating Trade Tensions: If U.S.-China trade tensions escalate, Thailand’s position as a manufacturing and logistical hub in Southeast Asia could be both an asset and a challenge. It must carefully balance its alliances to avoid alienating either major power while capitalizing on opportunities from reshoring supply chains and regional trade diversification.

Conclusion:

Thailand stands at a crossroads, with opportunities to bolster its economic resilience through careful diplomacy and strategic partnerships. Its ability to navigate the U.S.-China rivalry and adapt to shifting trade policies will be critical for its continued growth and regional influence.

Thailand Real Estate Market Outlook Amid Changing Global Dynamics

The real estate market in Thailand is currently navigating a combination of domestic and international influences. The potential return of Donald Trump as U.S. president introduces additional variables that could indirectly affect the sector. Here’s a breakdown of the key dynamics:

Foreign Investment Opportunities

- Increased Asian Interest: Thailand is a preferred destination for property investors, especially from China, Hong Kong, and Southeast Asia. With shifts in U.S. policies potentially favoring isolationist economic strategies, Asian investors might redirect capital to emerging markets like Thailand, bolstering demand for properties.

- Infrastructure Growth: Ongoing developments like the Eastern Economic Corridor (EEC) make Thailand appealing to foreign investors, particularly for industrial and mixed-use real estate.

Tourism and Rental Market

- Tourist-Driven Demand: The tourism sector continues to be a key driver for short-term rental properties, especially in hotspots like Phuket, Koh Samui, and Bangkok.

- Policy Sensitivity: Changes in visa regulations or economic sanctions could influence the profile of high-spending tourists from Western nations. However, Thailand’s primary inflow of visitors comes from China, Russia, and India, which mitigates reliance on Western tourist trends.

- Luxury Rentals: Policies affecting high-net-worth individuals could lead to fluctuations in the demand for premium rental properties in resort areas.

Property Prices and Affordability

- Luxury Segment: Prices for high-end properties and land in key tourist areas remain strong, driven by sustained demand. However, economic tensions between major powers like the U.S. and China could lead to price corrections as reliance on Chinese investment deepens.

- Market Stabilization: A steady influx of foreign buyers and domestic investments is expected to stabilize prices despite occasional fluctuations.

Long-Term Investment and Market Trends

- Resort Properties: Coastal and resort properties are increasingly attractive as investors look for passive income opportunities in stable real estate markets.

- Sustainability Appeal: Green and eco-friendly developments are gaining traction, particularly among European and North American investors.

Conclusion

Thailand’s real estate market remains resilient, driven by its strategic location, robust tourism industry, and infrastructure development. While global political shifts may introduce new challenges, the market’s dependence on Asian investment and domestic factors positions it for stable growth. Balancing relations with major economies like China and the U.S. will be crucial in maintaining this trajectory.