According to the latest data on Thailand’s real estate market, there is a significant change in the mix of foreign investors in the first quarter of 2024. Myanmar shows an impressive 415.79% increase in transactions, while China maintains its leading position despite a decrease in activity by 8.64%. Interest in real estate is also growing among US and German nationals, with transactions increasing by 5.13% and 15.27% respectively. At the same time, Russians continue to prefer Phuket and Samui, which emphasizes the attractiveness of these regions for investment.

- Real estate purchases in Thailand (Q1 2024 vs. Q1 2023)

- Preferences of foreign investors in Thailand (1Q 2024)

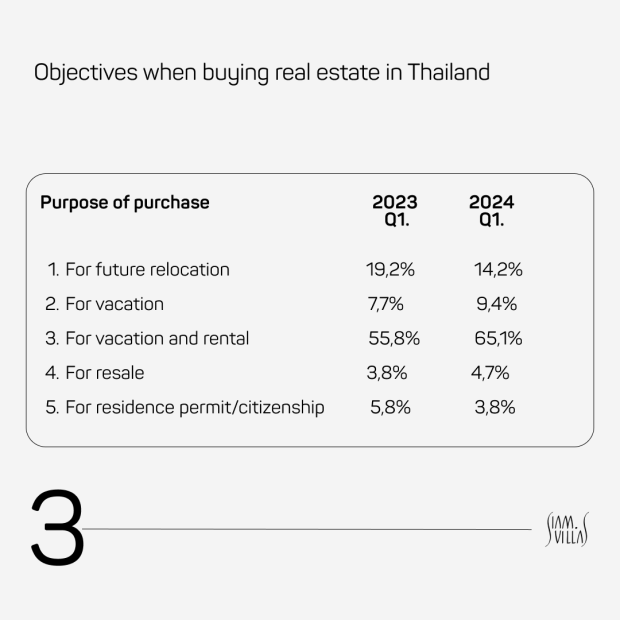

- Goals for buying real estate in Thailand

1. Real estate purchases in Thailand (Q1 2024 vs. Q1 2023):

- China still holds the lead in terms of number of deals, but there is a decline of 8.64% with 1,596 purchases compared to 1,747 in 2023. This may signal that the market is becoming more competitive.

- Conclusion: China remains an important player in the market, but the decline in deals may indicate a shift in interests.

- Myanmar has simply exploded the market with an increase of 415.79%, from 76 deals in 2023 to 392 in 2024. This impressive increase shows that interest in Thailand real estate from this country has become truly meaningful.

- Summary: The surge in transactions from Myanmar may be indicative of a new trend in the market.

- Russia decreased its activity by 23.77% (from 387 to 295 deals). This may be due to economic and political changes that affect demand.

- Conclusion: Decrease in activity of Russians indicates possible economic difficulties and uncertainties.

- The US showed a slight increase of 5.13% (164 vs. 156 deals). This is a positive signal that interest in our properties is recovering.

- Conclusion: The gradual increase in interest from the US indicates a recovery of the market.

- Germany also increased the number of transactions by 15.27%, indicating the sustained interest of European buyers in the Thai market.

- Conclusion: European buyers continue to show interest, which supports diversity in the market.

2. Preferences of foreign investors in Thailand (Q1 2024):

- Myanmar and the USA were the leaders in terms of the average cost of buying an apartment ($157,132 each). This may indicate a preference for larger and more expensive properties (average size – 43.9 m² and 60.3 m² respectively).

- Conclusion: The high cost of apartments indicates a growing interest in quality real estate.

- China is in third place in terms of value at $131,879, but with the most compact area of 39.6 m². This may indicate a desire to invest in more expensive neighborhoods with limited space.

- Conclusion: Investors from China seem to prefer more expensive neighborhoods.

- Russia offers the lowest average purchase price of $86,984 with 39.2 m² of space. This is explained by an interest in more affordable real estate.

- Conclusion: Russian buyers are focused on affordable options, reflecting the current economic situation.

- Germany ranks second in terms of area – 43.7 m², but last in terms of cost – $89,790, which may indicate a choice of more budget properties.

- Conclusion: German investors are choosing affordable options, possibly due to economic factors.

3. Investors’ objectives in buying real estate in Thailand:

- The main purpose of buyers is vacation and rental, which has grown from 55.8% in 2023 to 65.1% in 2024. This emphasizes the attractiveness of the rental market against the backdrop of tourist flow, which I think is great news!

- Summary: The increase in rental interest points to the growing tourist flow in Thailand.

The goal of future relocation decreased slightly from 19.2% to 14.2%.

- Summary: The increase in rental interest points to the growing tourist flow in Thailand.

- Purchase goals for vacation increased from 7.7% to 9.4%, suggesting that investors want to spend more time in the sunny kingdom.

- Conclusion: The need for vacations is increasing, which may lead to an increase in object sales.

- The purpose of buying for resale also increased from 3.8% to 4.7%, indicating an interest in speculating on the market.

- Conclusion: Interest in resale is increasing, which may be related to the hope of higher prices.

- Interest in buying for residence permit/citizenship decreased from 5.8% to 3.8%, which may be related to changes in legislation.

- Conclusion: The decrease in interest in residence permit may reflect changes in government initiatives.

Analysis of Thailand’s real estate market for the first quarter of 2024 shows dynamic changes and different trends among foreign investors. China’s leading position remains, although the number of transactions is declining, which may indicate temporary stagnation. At the same time, Myanmar shows an impressive increase in interest, indicating an active return of investors, which may be related to an improving economic situation.

The growth of average apartment prices in Myanmar and the US indicates a preference for more expensive properties, while Russians continue to focus on affordable options. Increased demand for rentals confirms the attractiveness of the market in the face of growing tourist traffic.

Buyers’ interest in Phuket and Samui emphasizes that these regions remain the main centers of attraction for investment, with a focus on luxury properties. At the same time, declining interest in purchase purposes related to relocation and citizenship may speak of growing uncertainty in the political and economic spheres.

Overall, Thailand’s real estate market continues to attract the attention of international investors, and it is important to keep a close eye on further trends and developments in order to adapt to new conditions.