What are the Thailand Property & Land Taxes?

As an expert in Thai real estate, I, Anna Miroshina, want to clarify the topic of property and land taxes in Thailand, which often catches buyers by surprise after completing their purchase. There are generally four types of taxes and fees involved. Which ones apply depends on the specifics of the transaction, such as the seller’s status and how long they’ve owned the property.

One crucial thing to remember is that these taxes are usually calculated based on the government’s “tax assessment value,” which is typically much lower than the actual market price. It’s essential to get the right advice early on to avoid unexpected costs.

Key Property and Land Taxes in Thailand

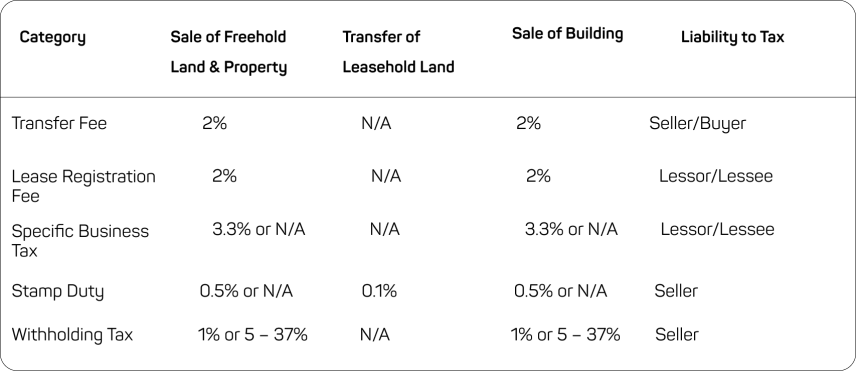

When buying property in Thailand, it’s essential to be aware of the taxes and fees involved to avoid surprises. Here’s an overview:

- Transfer Fee

This fee, based on the appraised value of the property, is typically shared between buyer and seller, although this must be agreed upon. - Lease Registration Fee

If leasing, the registration fee is calculated based on the total rent for the lease term. It’s also shared between lessor and lessee if agreed upon. - Specific Business Tax (SBT)

Applied to those who have owned the property for less than five years, it is calculated on the highest of the appraised value or the sale price. Homeowners who have lived in the property for over a year might be exempt. - Stamp Duty

Paid only if SBT doesn’t apply, stamp duty is also based on the highest value between the appraisal and sale price. - Withholding Tax (WHT)

If the seller is a company, WHT is calculated at 1% of the higher value. For individuals, it’s based on the marginal tax rate with a deduction based on years of ownership. - Land Tax

This annual tax is minimal for private residences but can be higher for properties owned by companies. It is paid to the local government but isn’t always enforced unless during property transfer. - Structures Usage Tax

Applicable to commercial or rental properties, this tax is 12.5% of the assessed rental value, which is usually lower than market rates.

It’s essential to work with a qualified lawyer to ensure all taxes are calculated correctly and paid on time, avoiding potential legal complications. If you plan to repatriate funds, proper documentation is key to avoiding tax penalties.

This streamlined version keeps the main points but trims excessive details, focusing on clarity. Let me know if you’d like to dive deeper into any section or add something!